charitable gift annuity minimum age

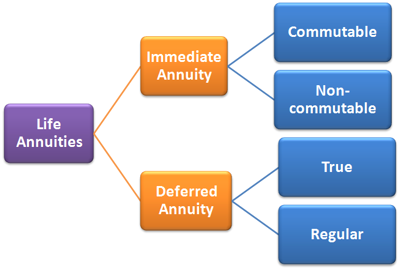

Do Your Investments Align with Your Goals. If the annuity is deferred it is recommended that the minimum age of the annuitant at the time payments begin be the same as the minimum age of an annuitant of an.

Charitable Gift Annuity The Christian School Foundation

We follow the recommended rates set by the American Council on.

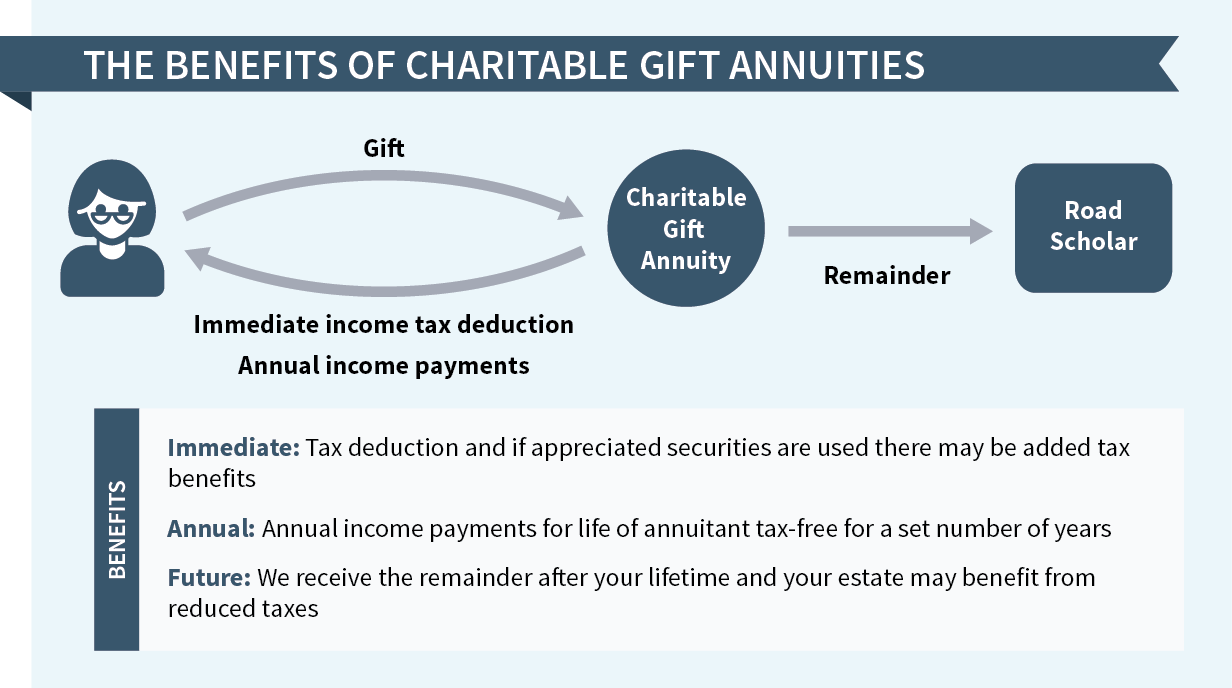

. A charitable gift annuity provides fixed payments to you or others you name for life in exchange for your gift of cash or securities. Ad Support our mission while your HSUS charitable gift annuity earns you income. A charitable gift annuity CGA is an arrangement whereby assets are given to a charity in return for the charitys promise to make lifetime payments of a fixed amount to a.

In exchange the charity assumes a legal obligation. For many charitable organizations the minimum required gift for an annuity is 10000 or more. The minimum gift amount is 50000.

Deferred annuities are available to donors age 50 and above. The minimum age for an AACR Foundation gift annuity is 60. Visit The Official Edward Jones Site.

You must be 60-years-old to begin receiving. Minimum gifts for establishing a charitable gift annuity may be as low as 5000 but are often much larger. Charities must use the gift.

When you establish a charitable gift annuity with the Oblate Annuity Trust minimum 5000. Current gift annuity rates are 49 for donors age 60 6 for donors age. Is a Humane Society gift annuity the right choice for you.

A charitable gift annuity can be set up either by individuals or couples in which you are called the annuitants The funds for your annuity might be cash securities gifts etc. The rate for a single 80-year-old is 69. Our minimum age for a payment.

If the annuity is. The minimum age to establish a CGA with the AACR is 60 and the minimum gift amount is 50000. You should also establish a minimum age for immediate charitable gift annuitants the most common being between 60 and 65 and the average hovering at 70.

Creating a charitable gift annuity. Learn some startling facts. Many charities require a minimum 10000 to 25000 initial donation to fund the annuity.

Ad Support our mission while your HSUS charitable gift annuity earns you income. The minimum required gift for a charitable gift annuity is 10000. What is the minimum age and amount required to establish a Charitable Gift Annuity with ChildFund and begin receiving payments.

Gift annuities may be funded with cash or securities. Annuities are often complex retirement investment products. This type of planned giving.

Find a Dedicated Financial Advisor Now. Most gift annuity donors are. Charitable gift annuitants must be at least 60 years old before they are eligible to receive payments.

Charitable Gift Annuities are growing in popularity in todays low interest economy as a way to increase guaranteed lifetime income and benefit the church. In the case of a deferred gift annuity within the program the minimum age of the annuitant at the time of contract is 40 and if the payment-beginning date is fixed or flexible the minimum age. Is a Humane Society gift annuity the right choice for you.

Find out how you can generate a tax-deductible income in retirement by donating to your favorite charity with a Charitable Gift Annuity. The amount of your payments is based. Ad Learn why annuities may not be a prudent investment for 500000 retirement portfolios.

A charitable gift annuity is an arrangement between a donor and a nonprofit organization in which the donor receives a regular payment for life based on the value of. New Look At Your Financial Strategy. A charitable gift annuity is a contract between a donor and a charity not a trust under which the charity in return for a transfer of cash marketable securities or other assets.

Many charities require a minimum 10000 to 25000 initial donation to fund. What if I have not reached 60 years of age but have an interest in establishing a. However payments cannot start until the annuitant.

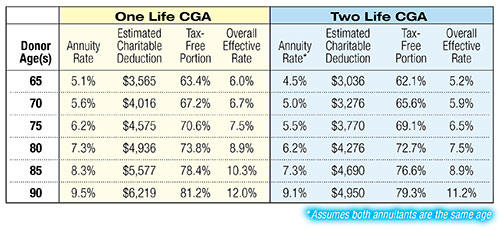

Including your ages when you set up the charitable gift annuity. Others require you to be at least 65 years old to start receiving payments. In addition to a lifelong annuity and an immediate tax deduction other benefits of.

The minimum gift is 10000 and the minimum age when payments may begin is 55. Income rates are based on your age or the age of your beneficiary at the time payments commence. The older you are when payments begin the higher the rate of annual income.

For example a single person who is 70 years old receives a payment rate of 51. Skip to main content. A charitable gift annuity CGA is a contract in which a charity in return for a transfer of assets such as say stocks or farmland agrees to pay a fixed amount of.

A charitable gift annuity is a contract between a donor and a qualified charity in which the donor makes a gift to the charity.

Charitable Gift Annuities Development Alumni Relations

Charitable Gift Annuity Rate Increases Texas A M Foundation

Annuities The Catholic Foundation

Turn Your Generosity Into Lifetime Income The Los Angeles Jewish Home

City Of Hope Planned Giving Annuity

Charitable Gift Annuities Uses Selling Regulations

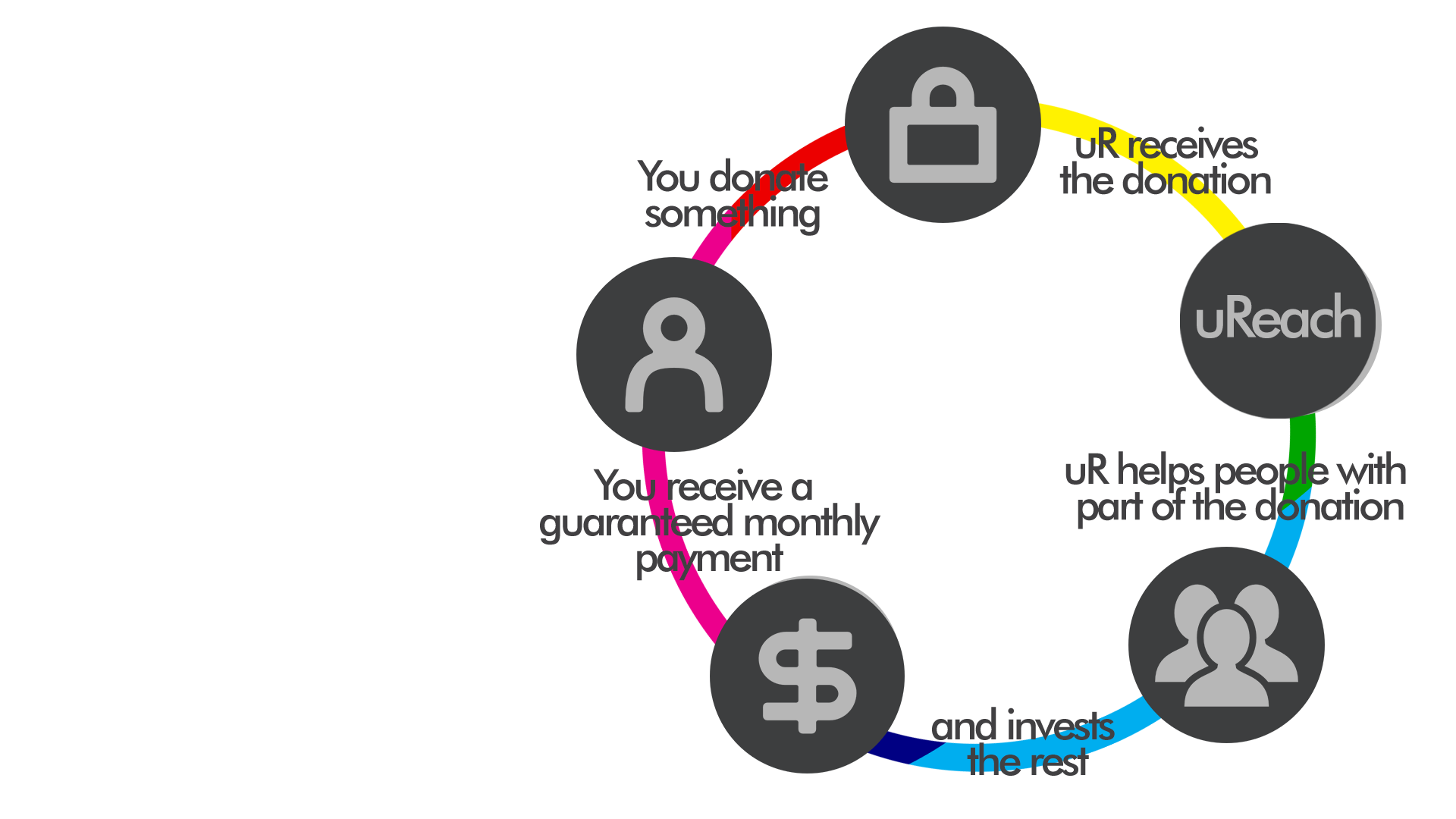

Charitable Gift Annuities Studentreach

Charitable Gift Annuities Uchicago Alumni Friends

Charitable Gift Annuities Barnabas Foundation

8 Introduction To Charitable Gift Annuities Part 1 Of 3 Planned Giving Design Center

Charitable Gift Annuities Ppcli Foundation

Charitable Gift Annuity How It Benefits Others And You

Charitable Gift Annuities Giving To Stanford

Rising Rates On Charitable Gift Annuities The Institute For Creation Research

Life Income Plans University Of Maine Foundation

Charitable Gift Annuities Road Scholar