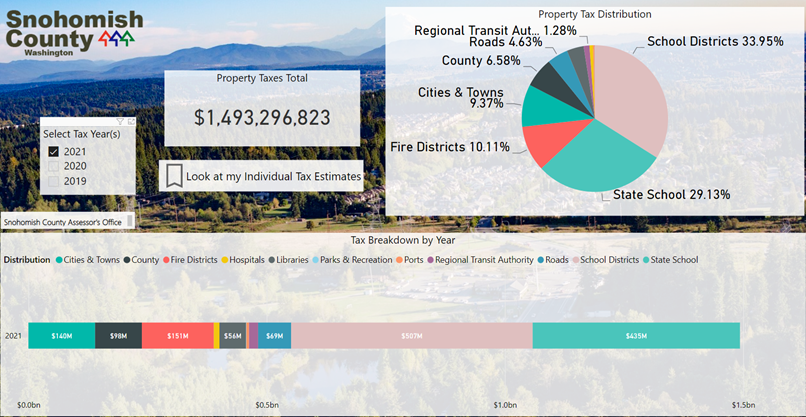

snohomish property tax rate

The City of Bothell receives approximately twenty percent of the property taxes paid on properties located in Bothell. Your household income and your age or disability determine your eligibility for both programs.

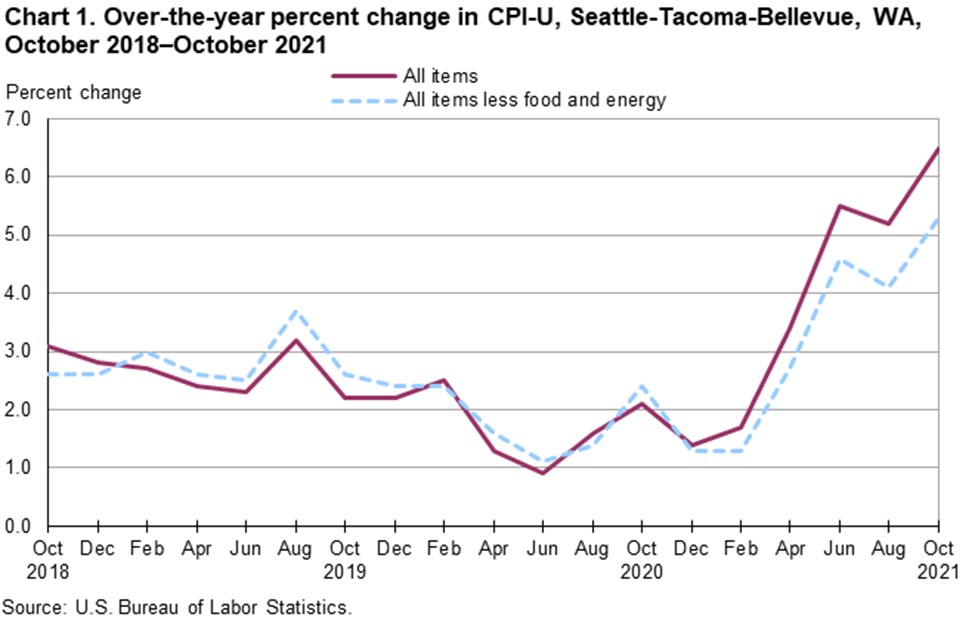

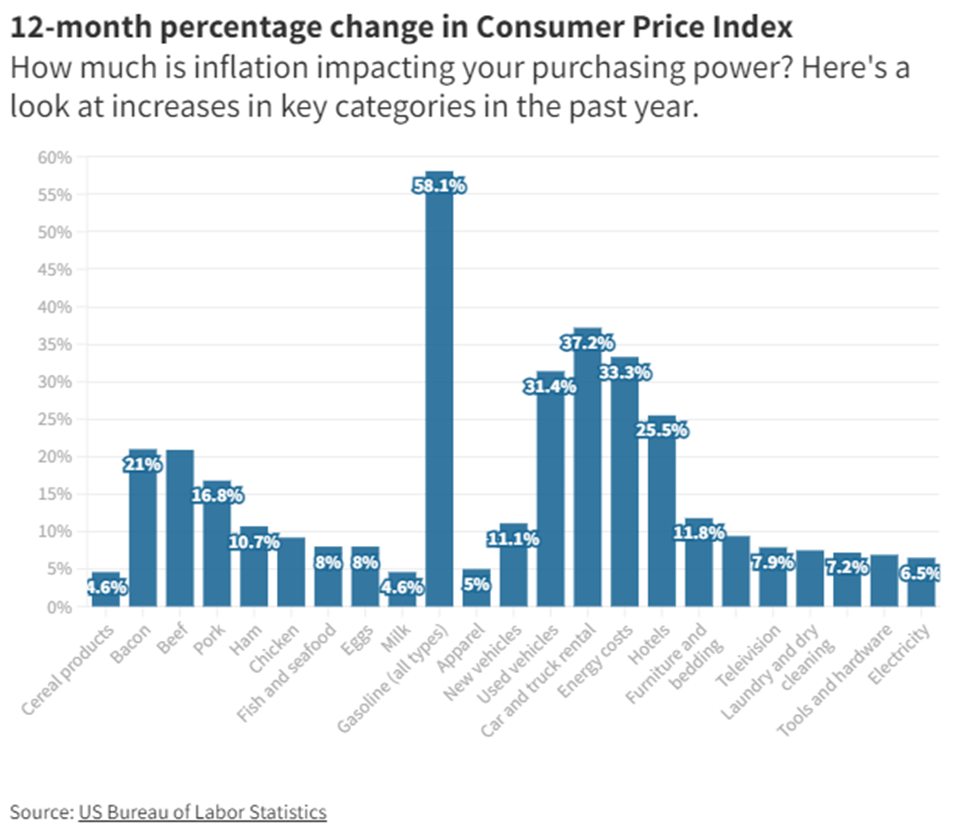

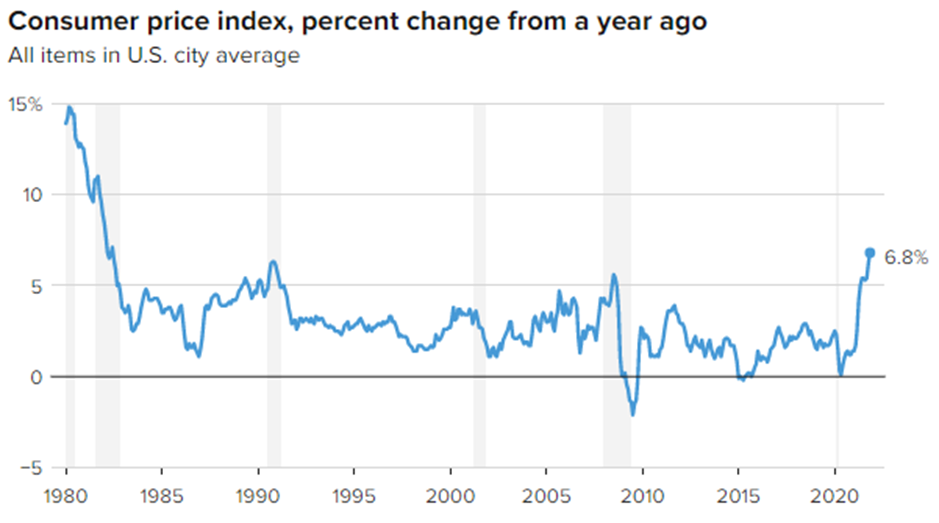

County Poised To Pass 0 1 Sales Tax As Inflation Hits 40 Year High Lynnwood Times

Snohomish County The Department of Revenue oversees the administration of property taxes at state and local levels.

. The assessed value of your property is multiplied by the tax rate necessary in your levy area to produce your fair share of the total levied tax by these jurisdictions. Why are Long Island property taxes so high. The City of Bothell portion of the property tax includes four components.

Snohomish County Treasurer 3000 Rockefeller. Explore important tax information of Snohomish. Snohomish WA 98291-1589 Utility Payments PO.

Welcome to the Snohomish County Assessors Office Website. Box 1589 Snohomish WA 98291-1589. The median property tax also known as real estate tax in Snohomish County is 300900 per year based on a median home value of 33860000 and a median effective property tax rate of 089 of property value.

The median annual property tax in Snohomish County is 3615 second-highest in the state and more than 1000 above the national median. Effective tax rate Snohomish County 00095 of Asessed Home Value Washington 00098 of Asessed Home Value National 00114 of Asessed Home Value. The following resources are available to assist you in understanding property taxes and property tax relief programs.

Accounts with delinquent taxes must first be approved by the Snohomish County Treasurers Office. Start Your Snohomish County Property Research Here. No call is required for payment of current year taxes.

Look Up Property Records. This means that property values in Long Island are more than twice the. Instantly view essential data points on Snohomish County as well as WA effective tax rates median real estate taxes paid home values income levels and even homeownership rates.

I encourage you to explore the tabs and buttons on the top and bottom of this page. Average Effective Property Tax Rate. Ad Get In-Depth Property Tax Data In Minutes.

The countys average effective tax rate is 115 which is higher than the state average of 093. The median property tax on a 33860000 house is 301354 in Snohomish County The median property tax on a 33860000 house is 311512 in Washington The median property tax on a 33860000 house is 355530 in the United States. The first half taxes are due April 30th 2022.

You will find a great deal of information available to you here including access to property information exemption forms property tax related RCWs our SCOPI mapping tool etc. Ad Need Property Records For Properties In Snohomish County. The voter approved Streets and.

Property tax exemption for senior citizens and disabled persons If you are a senior citizen or disabled with your primary residence in Washington State there are two programs that may help you pay your property taxes andor special assessments. The market value of your home multiplied by the assessment ratio in your area equals the assessed value of your property for tax purposes. The remaining approximately 80 goes to other taxing jurisdictions such as the Northshore School District the County and the State.

Box 1589 Snohomish WA 98291-1589 Report a Problem after-hours 360 563-2012 Non-police related. Snohomish County Treasurer Updates. If the assessor does not receive your form the assessor will estimate the value of the property based on the best information available.

The 2022 property tax statements should be received by taxpayers in mid-February. Start Your Homeowner Search Today. Search Valuable Data On A Property.

The Treasurer calculates the taxes due and sends out the tax notices using the taxing district information. 2022 taxes are available to view or pay online here. The Exemption Division is located in the Customer Service Center of the Administration East building of the county campus.

Property Tax Division PO. Box 47471 Olympia WA 98504-7471 360 534-1400. In our oversight role we conduct reviews of county processes and procedures to ensure compliance with state statutes and regulations.

Please call 425-388-3606 if you would like to make payments on your DELINQUENT property Taxes. Send your check or money order to. Eastern Washingtons Spokane County has property tax rates well above the state average.

Snohomish County Government 3000 Rockefeller Avenue Everett WA. Snohomish WA 98291-1589 Utility Payments PO. So if the assessed value of your home is 200000 but the market value is 250000 then the assessment ratio is 80 200000250000.

Property Values Are Higher The median price of homes in Long Island is about 500000. Appeal of Assessed ValueYou should contact the assessors office if you believe an assessment is incorrect. Penalty is five percent of the tax due per month up to a maximum of 25 percent.

Such As Deeds Liens Property Tax More.

Area Briefly Snohomish County Tax Statement To Be Mailed Soon News Goskagit Com

Property Taxes Rise For Most Of Snohomish County In 2020 Heraldnet Com

Redefy Real Estate Housing News 8 15 16 Nar National Average For Real Estate Real Estate Realtors Home Buying

County Poised To Pass 0 1 Sales Tax As Inflation Hits 40 Year High Lynnwood Times

Snohomish County Camano Association Of Realtors Home Facebook

County Poised To Pass 0 1 Sales Tax As Inflation Hits 40 Year High Lynnwood Times

Mountlake Terrace City Council Approves Property Tax Increase Code Updates Mltnews Com

Interactive Map Scopi Snohomish County Wa Official Website

County Poised To Pass 0 1 Sales Tax As Inflation Hits 40 Year High Lynnwood Times

Snohomish County Home Values Soar In Latest Assessment Heraldnet Com

By The Numbers Largest Taxpayers In Snohomish County Heraldnet Com

Graduated Real Estate Tax Reet For Snohomish County

Charming River Rock Fireplaces Craftsman House Rock Fireplaces

Property Taxes And Assessments Snohomish County Wa Official Website

Property Taxes Rise For Most Of Snohomish County In 2020 Heraldnet Com

County Poised To Pass 0 1 Sales Tax As Inflation Hits 40 Year High Lynnwood Times